The Best quotes from ai-PULSE 2024's keynotes

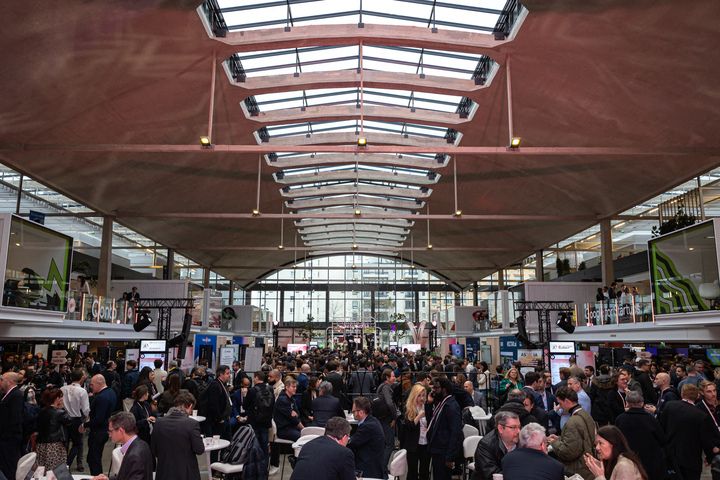

The second edition of ai-PULSE, held at Paris's iconic Station F on November 7, kicked off with a powerful morning session that highlighted some of the most compelling voices in AI today

As the financial services industry (FSI) continues to embrace AI advancements, many are seeking innovative ways to optimize processes, enhance efficiency, and respond to evolving market needs. At the intersection of AI and FSI, NEOMI, a leading player in AI-driven document management, is making substantial strides to show how financial institutions handle vast amounts of data.

This growing interest in AI's transformative power was also the focus of the Tech Minds Morning event organized by Scaleway and Artefact, which highlighted the incredible potential of generative AI in transforming the financial sector. This event brought together CTOs, CIOs, CDOs, and key decision-makers to explore challenges and opportunities driven by AI in financial services. Among the core themes, one crucial aspect is how AI can be harnessed to rethink risk assessments, improve decision-making processes, and automate operations in finance.

Operational efficiency is critical in the fast paced and competitive world on finance. Looking ahead, NEOMI's journey of utilizing AI to address these challenges serves as a key use case. Initially focused on the real estate sector, NEOMI has expanded its capabilities to tackle the complexities faced by financial institutions in managing their data. By leveraging AI-powered Vision Models, NEOMI is transforming the document processing landscape, an essential aspect for players in banking, insurance, and investment sectors.

In 2023, financial services companies spent $35 billion on artificial intelligence, across all sectors - banking, insurance, capital markets and payments - according to the World Economic Forum 2023 report. A significant part of this investment is driven by the need to improve core processes, such as document digitization and data extraction.

For years, traditional Optical Character Recognition (OCR) was the go-to solution for digitizing financial documents. However, OCR has inherent limitations—accuracy issues, lack of contextual understanding, and difficulty processing complex documents. In a highly regulated and data-sensitive industry like finance, these shortcomings can lead to inefficiencies and increased risk exposure.

For financial institutions, having access to reliable, accurate, and context-aware data is paramount. When data is incorrectly extracted or misinterpreted, the ramifications can be costly, particularly when it comes to assessing credit risk, compliance, and regulatory reporting.

Enter NEOMI’s next-generation Vision AI models. These AI systems go beyond the capabilities of traditional OCR by combining deep learning techniques to analyze both text and context in documents. In the financial sector, this means that AI can not only extract data from scanned contracts, invoices, or other documents but also understand the relationships between different data points and structures.

Increase Accuracy: By understanding document structure and context, AI can drastically reduce errors, ensuring that financial institutions make well-informed decisions based on reliable data.

Enhance Compliance: Vision AI can automatically extract and categorize documents, ensuring that firms meet regulatory standards without having to manually sift through piles of paper or digital forms.

Accelerate Automation: With an intelligent AI system, tasks like data entry, document categorization, and compliance checks can be automated, leading to significant cost savings and operational efficiency.

NEOMI is taking AI adoption a step further by seamlessly integrating Vision AI into their document management platform. The transition from traditional OCR to AI-powered Vision Models has empowered NEOMI to unlock hidden data from documents, which previously required manual analysis. This has major implications for the financial industry, particularly in the context of ESG (Environmental, Social, and Governance) regulations. NEOMI's upcoming platform expansion will address ESG reporting challenges, further demonstrating the potential for AI to help financial institutions not only manage risk but also stay ahead of regulatory changes.

Furthermore, NEOMI is exploring AI's potential in streamlining complex financial transactions, including asset financing and banking agreements. We realize that by automating the extraction and organization of data, financial institutions can improve operational efficiency, reduce processing time, and make data-driven decisions with greater confidence.

AI’s role in transforming key business functions in the Finance sector has never been more important. Financial workflows highlights how AI can empower FSI professionals to tackle some of their most pressing challenges, including risk management, regulatory compliance, and operational efficiency. With the future of finance clearly linked to AI innovation, this is a conversation every decision-maker in the FSI sector should be part of.

Fraudsters are always going to try the most advanced, newest things that they can, and traditional non cognitive approaches will not always pick up on that suspicious activity but AI tools spot unusual patterns often invisible to traditional systems. These technologies enable us to detect weak signals and act quickly to secure payments. By cross-referencing a variety of data - purchasing behavior, online activity, financial history - it offers a more complete view of a borrower's profile. The result: better-informed decisions, fewer payment defaults, and greater access to credit for those excluded by conventional methods.

Those who adopt these technologies early will be well-positioned to lead in an increasingly competitive and data-driven financial market.

The second edition of ai-PULSE, held at Paris's iconic Station F on November 7, kicked off with a powerful morning session that highlighted some of the most compelling voices in AI today

Last week's AI Action Summit highlighted key principles shaping the future of AI: Big, Efficient, and Open. Read the full article for an inside look at the event and insights about it.