Behind the scenes of the night our transformer shut down in our data center

One night in September, a power transformer shut down in one of our Parisian data centers. Read on to find out what happened during this tense night.

Since the second half of 2020, demand for semiconductors has exceeded supply. Cue a global shortage, which, aggravated by pandemic-induced lockdowns, has left the world reeling.

The fallout? Prices for consumer electronics spiked, car manufacturing stalled, and huge lines at the leading chip manufacturers have had reverberating effects on the tech industry at large, including cloud service providers.

More importantly, current supply issues have served as a reality check for tech companies and governments on the dangers of hyper-dependence on a handful of chip manufacturers, most notably Taiwan.

Consequently, the EU and the US are scrambling to reduce this dependence, with what could be called ‘chip sovereignty’ a new priority. Given today’s total lack of control over supply chains and deteriorating geopolitical stability, the need for local, independent solutions has rarely been more pressing.

To that end, the European Commission is looking to massively boost semiconductor manufacturing in the bloc, as part of its 'Digital Compass' policy program, with the European Chips Act. On the other side of the Atlantic, the US' own CHIPS Act recently passed the Senate, to subsidize new chip manufacturing facilities in the US. Meanwhile, leading global players China and South Korea are also aggressively upping their investments in the industry.

Talent and the lack thereof is a problem, too – who will work in the new factories and supply chains? The industry is currently experiencing some of the fiercest competition ever for qualified workers. Even Taiwan's well-oiled talent mill is struggling to keep up, and vacancies for semiconductor engineers are up 40% compared to the same period last year.

Nevertheless, short-term shortages and talent challenges are issues that must be powered through to achieve all-important regional stability and strategic security in semiconductor supply.

How critical is the chip shortage?

Will there even be a chip shortage in 4 years? The signals are mixed. On one hand, with increased throughput, experts expect the overall situation to improve this year, and even stabilize by 2024. On the other, accelerating digitalization and electrification are likely to drive up demand to unprecedented levels as, for example, connected device numbers are forecast to nearly double by 2025. Add to this ongoing current tension between Taiwan and China, set to last for the foreseeable future, and the outlook is decidedly uncertain.

The trouble is that funding boosts won't alleviate any short-term woes of the acute chip shortage. For instance, Intel is looking at two new factories in Ohio, but going from beginning construction on a factory to putting a chip in a device will take three to four years. That's 2026. And it's the same story in Europe.

There are, indeed, pockets of semiconductor producers around Europe, responsible for around 10% of global chip production. Europe's Chips act aims to double this to 20% of the global share, to bolster the region's digital sovereignty… although specific sectors such as automotive - which was among those sectors most affected by the chip shortage - and IoT are expected to be the main beneficiaries here.

This is very much the case in Grenoble, France, which will see a new semiconductor manufacturing factory – a joint project by STMicroelectronics and GlobalFoundries – and Intel plans to invest €17 billion in a new foundry in Magdeburg, Germany. Additionally, local up-and-comers such as the French SiPearl will also benefit from the burst of interest in homegrown chip development and production.

More generally, domestic semiconductor manufacturing will serve to ensure a more robust European tech ecosystem and bolster the region's self-sufficiency to the benefit of local players. To that end, European tech companies and the broader population should be deeply invested in the success of this project, lobbying for it and buying local, when possible.

But whilst boosting European chip-making would have all sorts of upsides, it could never fully resolve today’s supply problems. Simply because relocating the entire chip production process is technically impossible, at least for now. Chip manufacturing starts with a silicon “boule”, a raw material which currently can only be made in a handful of countries; and that is unlikely to change for 5-10 years.

Even though the pre-production stage remains locally limited, shifting the foundry-to-launch process to Europe is both technically feasible, and preferable in terms of sovereignty, since blueprints of chip designs wouldn’t have to be sent to Asia, or the US, to complete their manufacturing.

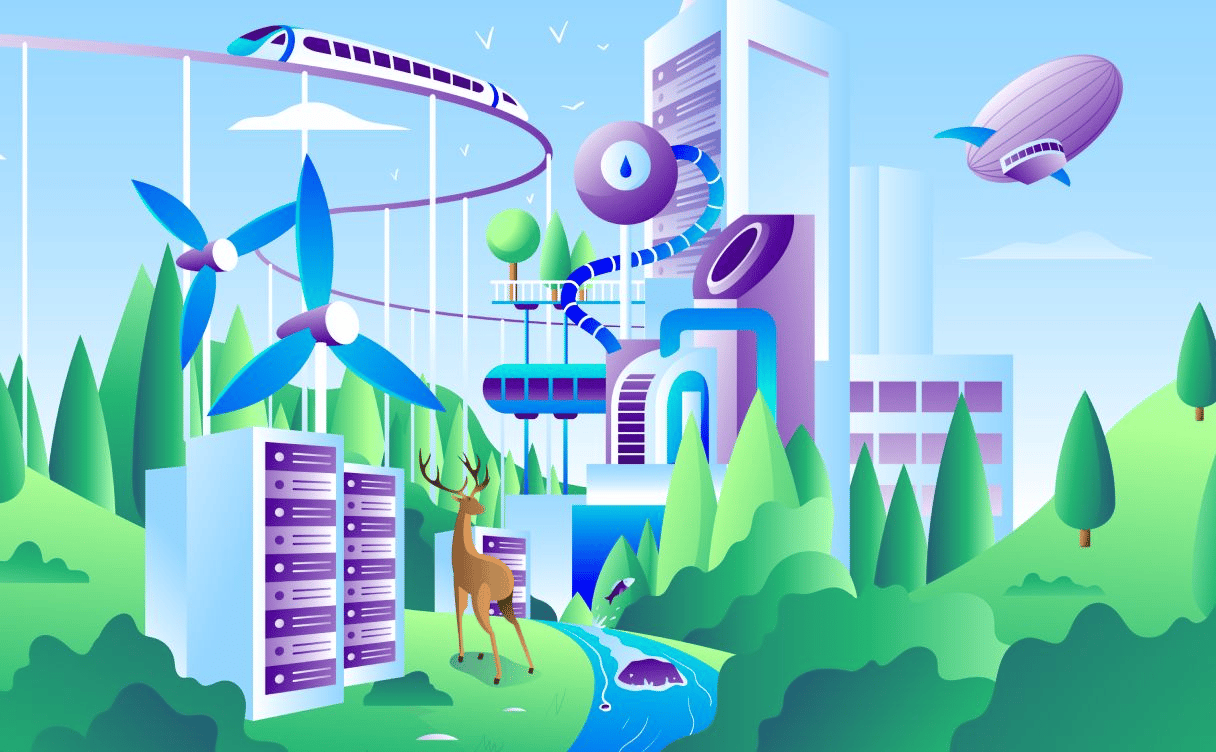

For Europe to meet its own high environmental standards and sustainability targets, it's not just about increasing production, but boosting the “production of cutting-edge and sustainable semiconductors”. Recent climate incidents in Europe and beyond serve as a stark reminder that climate change must not be ignored and digital sobriety must permeate not just usage, but production, too.

Semiconductor manufacturing is one of the most resource-intensive sectors in the world, and more robust standards are required to, if not stall, then at least slow its growing environmental impact. For example, Taiwan Semiconductor Manufacturing Company (TSMC), the world's biggest chip manufacturer, uses 156,000 tonnes of water per day in its activities (although 87% of that is recycled afterwards).

For Europe to do better likely means additional upfront expenses, some of which will get passed down to businesses.

And that's fine.

So whilst there is hope for the balance of chip power to shift more towards Europe in the future, this evolution could clearly take years. What can be done to move towards a more sustainable sector in the meantime?

Firstly, the creation of one just chip requires multiple airplane trips around the globe, as all components are flown into foundries. Then, further upstream, the manufacturers of those components need to shift to more sustainable practices, be it silicon, chemicals or backend housing.

But for now, one of the most rapidly actionable solutions could be re-use of hardware. Be it by relying more on refurbished/repurposed hardware and extending the lifespan of current devices, or paying a premium for products with less environmental impact (always consult product impact documents!), tech companies must take responsibility for and minimize their carbon, water, and energy footprints.

Indeed, it's essential to remember that it's not just about the chips themselves, but the entire supply chain. Major buyers of IT hardware, like cloud service providers, should reduce the impact of their sourcing by, for example, insisting that suppliers:

Moreover, sourcing and assembling locally (e.g. housings for servers) helps not only further reduce a company's environmental impact, but also props up the local ecosystem that will play a key first step towards achieving microchip sovereignty in Europe.

Today, decade-old mantras that geared the sustainable food movement are growing relevant for IT firms in general, cloud providers in particular, and the tech sector overall – buy local, buy sustainable, and use up what you have.

But this time, it's not just about saving the planet: it’s also a matter of regional security; and the improved resilience of one of Europe's most important sectors.

One night in September, a power transformer shut down in one of our Parisian data centers. Read on to find out what happened during this tense night.

In today's data-driven world, GPUs are the hardware of choice for training Deep Learning models. What about tasks that do not involve artificial neural networks?

Today, cloud service providers (CSPs) are tied in a ‘sustainability race’, all vying to claim their solutions have the least impact on the environment.